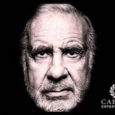

In the United States, the billionaire owner of casino operator, Landry’s Incorporated, Tilman Fertitta (pictured), has reportedly approached bigger rival Caesars Entertainment Corporation regarding the prospect of a merger.

‘Reverse merger’ suggestion:

According to a Wednesday report in the Reuters news service citing an unidentified source, 61-year-old Fertitta has suggested executing a ‘inverse merger’ which would visit Caesars Entertainment Corporation serve as the buyer with its bevy of shareholders, which include private equity firms TPG Global and Apollo Global Management LLC, retaining their stakes at the enlarged venture.

Golden Nugget casino collection:

Reuters reported that Houston-based Landry’s Incorporated accounts for five Golden Nugget-branded casinos in four states and is thought to have a market capitalization of around $6.3 billion. It detailed which Fertitta himself is worth roughly $4.5 billion and moreover owns the Houston Rockets franchise of the National Basketball Association (NBA).

Nevada company excited to catch up:

Reuters reported that the vegas -based operator’s arrears are now though to stand at about $9 billion with the company eager to catch up with rivals including Wynn Resorts Limited and Las Vegas Sands Corporation whilst paying down debts and enhancing profitability.

Complete plate situation:

However, the news service reported that Caesars Entertainment Corporation has recently been concentrating on the possibility of purchasing at least a component of Detroit-headquartered Jack Entertainment, that has a rating of around $3 billion and holds interests in six casinos such as Ohio’s Jack Cleveland Casino. Additionally, July watched the Nevada giant further expand into Indiana after completing its $1.6 billion acquisition of local operator Centaur Holdings with its five possessions.

Adding to the complexity of almost any future buy, Reuters reported that hedge fund HG Vora Capital Management LLC has built up a 4.9% stake at Caesars Entertainment Corporation and hopes to persuade the company to explore further rewarding options which could encompass divestitures or an outright sale.