The billionaire businessman supporting American casino operator Jack Entertainment is reportedly considering an exit from the business with giant rival Caesars Entertainment Corporation said to be one of the list of potential bidders.

Helped bring casinos to Ohio:

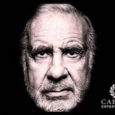

Based on a Wednesday report from the Bloomberg news service, Dan Gilbert (pictured) is worth an estimated $7.8 billion thanks for his Quicken Loans Incorporated mortgage lending firm and created Detroit-based Jack Entertainment in 2009 later helping to back a ballot measure that legalized casino gaming from Ohio.

The news service noted that the 56-year-old businessman serves as Chairman for Jack Entertainment and holds interests in six casinos and racetracks such as the Detroit Casino Hotel Greektown in Addition to Ohio’s Jack Cleveland Casino, Jack Cincinnati Casino and Jack Thistledown Racino.

Downtown casinos neglect:

Gilbert moreover owns the Cleveland Cavaliers franchise of the National Basketball Association (NBA) and had reportedly expected that his downtown casinos in ‘rust belt’ cities such as Cincinnati and Cleveland will help to revive their local economies. But this has purportedly proved harder than expected with his Ohio places recently ranking fourth and third concerning earnings among the Midwestern state’s four stand-alone gaming venues.

Operator not commenting on ‘rumors or speculation’:

Bloomberg cited ‘individuals acquainted with’ Gilbert’s plans in detailing that investment banks Credit Suisse and Deutsche Bank are representing Jack Entertainment in the potential sale process although the casino operator itself reportedly reacted to the news service’s inquiries by declaring that it has a ‘longstanding coverage ’ of not commenting on ‘rumors or speculation’.

Pair no strangers:

For its part, Caesars Entertainment Corporation is reportedly no stranger to Gilbert as the parties were partners in the Cincinnati and Cleveland casinos, that was branded under the Horseshoe Casino moniker, until Jack Entertainment assumed complete control three years back and changed their titles . The Las Vegas-based operator is currently purportedly considering whether to combine with its Vici Properties Incorporated property investment trust (REIT) in order to acquire at least a portion of its smaller rival’therefore business.