Billionaire businessman Tilman Fertitta has bought a stake in gaming and hospitality giant Caesars Entertainment Corp., Bloomberg reports citing people familiar with the matter

News about Mr. Fertitta buying Caesars shares arrived a few months after the real estate mogul made an offer to purchase the company and step in as its leader.

The businessman bought about 4 million shares in the hotel and casino operator, which represents less than 1% of the company’s total. Sources told Bloomberg that Mr. Fertitta believes Caesars is undervalued and that he is still interested in merging his own empire with the Las Vegas gambling powerhouse.

Caesars is still fighting the consequences of a $30.7-billion leveraged buyout gone incredibly wrong. In 2015, the gaming and hospitality operator put its main operating unit in bankruptcy. It emerged from lengthy and complex Chapter 11 bankruptcy proceedings in the fall of 2017 and is now looking to pay down a $9 billion debt, while competing for a bigger market share.

Mr. Fertitta, whose personal fortune stands at around $4.7 billion (Forbes, February 2019), is the sole owner of the Golden Nugget chain of casinos as well as of restaurant and entertainment company Landry’s. A Texas native, the businessman also purchased the Houston Rockets in 2017.

News emerged last fall that Mr. Fertitta approached Caesars with an offer to merge his gaming and entertainment business with that of the Las Vegas gambling giant. The businessman proposed that Caesars acquire his entities in exchange for a controlling stake. Mr. Fertitta reportedly offered to take up the reins of the combined business. Caesars rejected that offer, but as mentioned earlier, sources believe the real estate mogul is still interested in consolidating his business with that of the much larger gambling and hospitality operator. Caesars currently manages around 50 gaming and non-gaming properties in 13 states and five countries and eyes further geographical expansion.

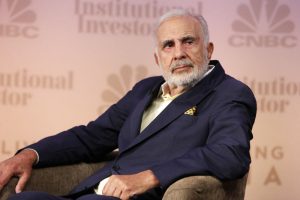

Carl Icahn Presses for Sale

The Wall Street Journal reported earlier this week citing people familiar with the situation that Mr. Icahn believes Caesars has “desirable properties and that the outlook for Las Vegas is positive.” It also seems that the businessman investor thinks the gaming and hospitality company would perform better with “a rival” at its helm.

Mr. Icahn is the former owner of Trump Taj Mahal, which now operates as Hard Rock Hotel & Casino Atlantic City, as well as of a number of gaming properties in Las Vegas, including the Stratosphere.

The New York activist investor has not been the only Caesars shareholder to be pressing for the company’s sale. It surfaced last year that hedge fund HG Vora had quietly amassed a stake in the casino and hospitality operator to push for its sale or at least divestment of some of its assets.

Follow us on Facebook and Twitter to stay up to date on the day’s top casino news stories.