Caesars and Eldorado are reportedly exploring a merger that could create a $9 billion casino and hospitality powerhouse

US gaming and hospitality operators Caesars Entertainment Corp. and Eldorado Resorts Inc. are holding early talks of a potential merger, Reuters reports citing unnamed sources familiar with the matter.

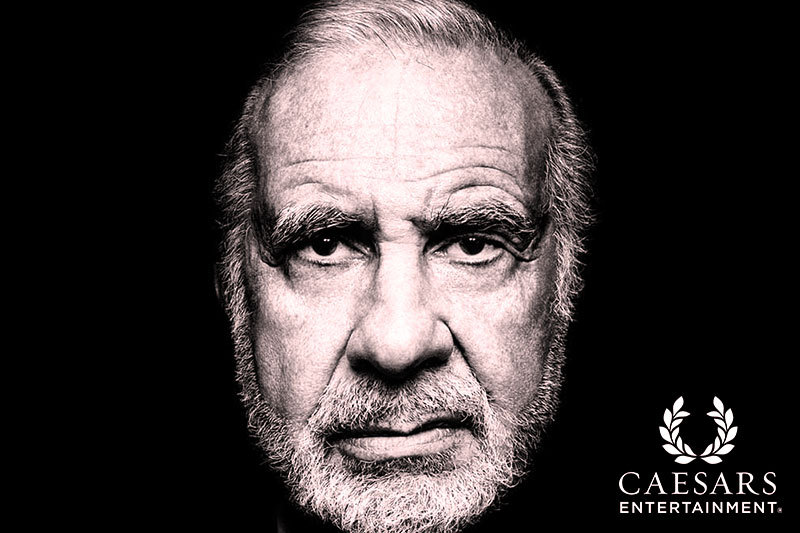

News about a possible tie-up between the two companies are being brought as Caesars’ largest stakeholder – New York billionaire investor Carl Icahn – is pressuring the Las Vegas hotel and casino behemoth to merge or sell itself.

According to sources who asked not to be named because of the confidential nature of the matter, Caesars is providing limited financial information to Eldorado, which has begun due diligence on a potential merger of the two operators.

Eldorado has not made a binding offer yet, it has become known. Sources also said that there is no certainty that the ongoing discussions would result in a transaction.

Eldorado Resorts owns and operates 26 properties across 12 US states. Most recently, the company acquired fellow gaming and hospitality operator Tropicana Entertainment namely from Mr. Icahn’s Icahn Enterprises in a $1.85 billion deal. Tropicana runs casino properties in New Jersey, Indiana, Nevada, Louisiana, Mississippi, and Missouri.

Caesars currently owns more than 50 properties across 14 US states and five countries outside the United States. The company’s main operating unit emerged from a lengthy and complex bankruptcy in the fall of 2017, after failing to erase a $25 billion debt. As of December 2019, Caesars’ long-term debt stood at around $9 billion.

Previous Merger Talks

News also broke last fall that Texas billionaire Tilman Fertitta was interested in combining Caesars with his own, smaller, gaming and hospitality empire, Golden Nugget. Caesars eventually rejected Mr. Fertitta’s takeover bid, but reports emerged last month that the businessman has not given up hope for a tie-up with the Las Vegas giant.

As mentioned above, Mr. Icahn has become Caesars’ largest stakeholder. The businessman has been raising his stake in the company over the past few months. According to a GuruFocus report, the activist investor’s holding in Caesars currently stands at around 20.88% after the most recent purchase of shares of the casino operator.

Mr. Icahn has secured board representation in Caesars’ Board of Directors after the company agreed to appoint three new members who were named by the businessman. The billionaire investor could name a fourth member if Caesars fails to appoint a new CEO within a 45-day period after the recently announced signing of an agreement with Mr. Icahn.

The businessman is pushing the company to merge or sell itself as he believes this is the “best path forward for the company” and the best opportunity to create shareholder value. Mr. Icahn also wants a say in the selection of a new Caesars CEO. The company’s current chief, Mark Frissora, is due to step down in April. Mr. Icahn has reportedly recommended Affinity Gaming CEO Anthony Rodio as the successor to the company’s outgoing top executive. Mr. Rodio was previously CEO of Tropicana.

According to sources, Caesars has a shortlist of candidates for the CEO position and has informed Mr. Icahn that it is willing to consider his recommendation, as well.

Follow us on Facebook and Twitter to stay up to date on the day’s top casino news stories.

Skrill Microgaming Casinos

Skrill Microgaming Casinos

Carl Icahn Stake in Casino Giant Caesars Keeps Growing

Carl Icahn Stake in Casino Giant Caesars Keeps Growing

Caesars Trims Corporate Workforce to Cut Annual Costs

Caesars Trims Corporate Workforce to Cut Annual Costs

Carl Icahn Further Increases Stake in Caesars

Carl Icahn Further Increases Stake in Caesars

Carl Icahn Becomes Caesars’ Largest Shareholder; Company Owners Halve Stake

Carl Icahn Becomes Caesars’ Largest Shareholder; Company Owners Halve Stake