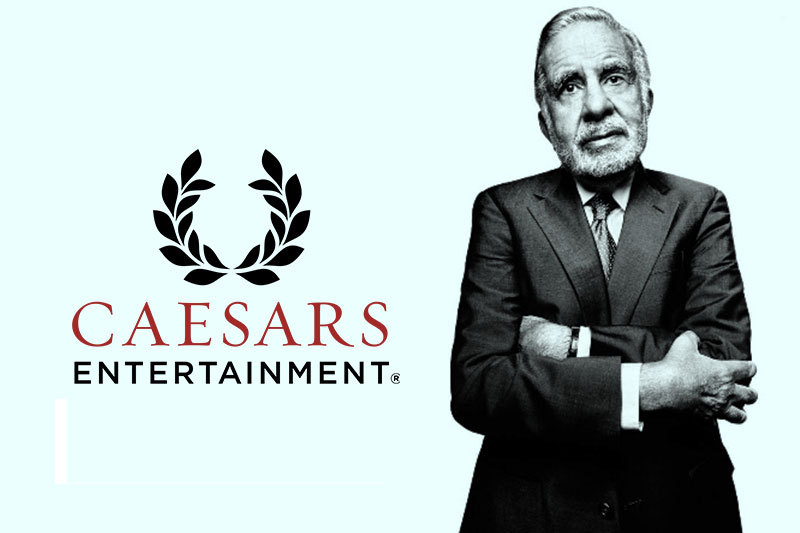

Hospitality and gaming powerhouse Caesars Entertainment Corp. is reportedly in talks with Carl Icahn to offer you the New York activist investor a role in selecting its new CEO, Reuters reports citing unnamed sources knowledgeable about the matter.

The continuing talks also have an agreement between the company and the businessman that could give him board chairs. The most recent reports surrounding the potential for Caesars arrive shortly after Mr. Icahn confirmed last week in a filing with the US Securities and Exchange Commission who he’s amassed a 9.78% stake in the resort and casino operator he believes its potential sale could offer the best value for its stockholders.

Caesars stated in a response to Mr. Icahn’s filing that it has participated in talks with the businessman and it would consider all his suggestions.

It also became famous from past week’s SEC filing the billionaire investor intends to nominate “a record of supervisors ” into Caesars’ board during the business ’s annual shareholders meeting.

The casino operator is allegedly in discussions with Mr. Icahn to provide him board chairs. Unnamed sources with all the continuing talks said on Sunday the billionaire investor has proposed Anthony Rodio as the new CEO of Caesars when Mark Frissora steps down.

Mr. Frissora was going to leave in February, but the firm said not long ago that he’ll remain at its helm for a little longer.

CEO Candidates Shortlist

Caesars already has a shortlist of candidates to succeed Mr. Frissora. The company has allegedly told Mr. Icahn it will think about his offender , too. Mr. Rodio is now the CEO of private gambling company Affinity Gaming.

According to sources, Caesars is open to providing Mr. Icahn with board representation. The businessman could get an important minority at the 12 board seats, sources consider. The deadline for Mr. Icahn to nominate board supervisors expires on March 1, meaning that ongoing negotiations between the investor and Caesars could lead to a deal in the next few days.

If a deal is not reached, the casino operator could either expand the nomination period or continue talks with Mr. Icahn even if he documents a board background for election, sources pointed out.

The New York activist investor is not Caesars’ only shareholder to be pressing to your company’s sale. News appeared over the weekend that the company’s largest stockholder, Los Angeles hedge fund Canyon Partners, believes shareholder value will be “best served and enhanced by an open sale process. ” It had been reported last summer that another hedge fund, HG Vora, had built a 5 percent stake in Caesars and has been urging the company to sell itself.

Follow us Facebook and Twitter to stay up to date on the day’s top casino news reports.

Caesars Engages in Discussions with Carl Icahn over Sale

Caesars Engages in Discussions with Carl Icahn over Sale