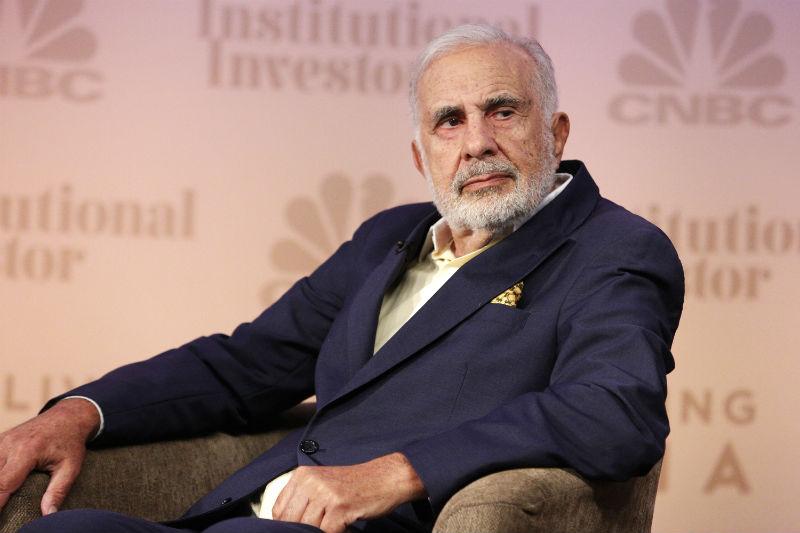

Carl Icahn Constructing a stake in Caesars makes a purchase deal more affordable for any suitor of This Firm

Texas billionaire Tilman Fertitta is planning to create a fresh new deal to acquire Caesars Entertainment Corp.. , along with his bidding may be boosted by the company’s controlling stakeholder, Carl Icahn, the New York Post reported earlier this week mentioning information from unnamed sources.

The businessman approached Caesars last fall using a takeover provide that could have seen the combination of the vegas casino and hospitality powerhouse using Mr. Fertitta’s smaller casino business. Caesars declined the deal, discouraged by the fact that a transaction would have ballooned its own debt, which stood at around $9 billion in the time.

Mr. Fertitta has reportedly been searching for cash spouses to shore up his bidding over the past several months. Bloomberg reported last month that the businessman has purchased 4 million shares of Caesars, which represented less than 1 percent of the company’s total stock.

Sources told the New York Post that while Mr. Fertitta has not found cash spouses, he is gearing up to make a new deal for your resort and casino operator. According to people knowledgeable about the ongoing improvements, the businessman’s bid to purchase Caesars can get help from the simple fact that the organization ’s biggest shareholder — New York billionaire investor Carl Icahn — is pressing for sale, while amassing a whopping stake.

Affordable Deal

The billionaire investor will be eligible for fourth board seat if Caesars fails to replace its incoming CEO Mark Frissora by mid-April.

With Mr. Icahn owning a 28.5% stake in the organization, any interested purchaser would only need to purchase the remaining 71.5percent , making the deal much more affordable for Mr. Fertitta than it might have been last fall, if Caesars hadn’t declined it.

News emerged earlier this week which Caesars and fellow casino operator Eldorado Resorts were at the early stages of merger discussions . According to sources, Caesars has given Eldorado accessibility to certain financial data so the latter can choose whether to make an offer.

Mr. Icahn has said that a merger or purchase is the best path forward for Caesars and has encouraged the company to research available opportunities. In addition, the businessman needs a person with expertise in the gambling industry to take over as CEO and assist the Las Vegas casino giant trim corporate and other costs.

The New York activist investor is also reported to be pressing Caesars into concentrate on its domestic company instead of expanding into Asia. The business recently started two non-gambling hotels in Dubai and is planning to bid for a casino license in Japan.

Follow us on Facebook and Twitter to stay up to date on daily ’s leading casino news stories.

Tilman Fertitta Still Interested in Caesars Merger, Buys Stock from the Casino Giant

Tilman Fertitta Still Interested in Caesars Merger, Buys Stock from the Casino Giant

Carl Icahn Reportedly Presses for Caesars Sale

Carl Icahn Reportedly Presses for Caesars Sale