Another Important Caesars stockholder is pushing for the Organization ’s Purchase to best Function and enhance shareholder value

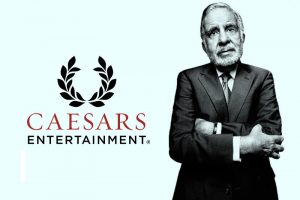

Caesars Entertainment Corp.’s largest shareholder is urging the company to consider a purchase , linking billionaire Carl Icahn and other investors that are pressing the gaming and hospitality giant to initiate a search for a buyer.

Los Angeles hedge fund Canyon Partners LLC said in a statement on Friday that its current view is that shareholder value “could be best served and enhanced by an open sale process. ” The company holds nearly 70 million shares in Caesars, or more than 10%. It’s the vegas hospitality and gaming ’s largest stockholder.

The business emerged out of a intricate bankruptcy process in the autumn of 2017 and embarked on a mission to procure better customer value, improved profitability, and continuing expansion.

The business introduced its full-year outcomes for 2018 earlier this week, reporting earnings growth of 72.4percent to $8.39 billion and net earnings of $303 million up from a loss of $368 million. The improved results were attributed to the addition of the outcomes of Caesars’ main operating unit after the emergence from bankruptcy and also of Centaur Holdings, which the vegas powerhouse acquired last summer.

Caesars also said that in its own full-year fiscal report that its CEO, Mark Frissora, that was due to leave his post this month, will stay at least up until the end of April. Given that many of Caesars’ investors are pressing for the organization ’s purchase, an executive shakeup could be the final thing they want.

Mr. Icahn also said in a statement from earlier this week that Caesars’ stock is undervalued at present and that “shareholder value might be best served and enhanced by selling the company. ” The vegas giant said in a statement that it has participated in talks together with all the billionaire investor and that it is going to consider all of his suggestions regarding its future.

Besides Canyon Partners and Mr. Icahn, it also became known that Oppenheimer Funds, which owns 10 million shares, has told Caesars that it shouldn’t appoint a new CEO or board members before its direction believes a sale.

Reports surfaced last summer that hedge fund HG Vora Capital Management had softly built a 5 percent stake at Caesars and has been pushing to get a sale.

Bloomberg reported last weekend that Golden Nugget proprietor Tilman Fertitta has bought a nearly 1 percent stake in the vegas casino operator. Mr. Fertitta made an offer last fall to merge his gambling and restaurant company with Caesars and become CEO of the combined entity. Caesars refused his offer, however, the businessman is allegedly still curious at a merger.

Follow us Facebook and Twitter to stay Current about the day’s top casino news reports.